And while it seemed to be stabilizing, Bitcoin is once again under threat of collapse, as the Chinese government announced on Friday (April 21st) that it would impose severe restrictions on cryptocurrency mining and trading – to the point that many analysts are talking about a ban.

“Let China ban bitcoin mining.

“So mining will become more decentralized, the black market will thrive and the lie that China controls the digital market will collapse,” said well-known Whalepanda analyst.

In particular, according to a written statement by Chinese Vice President Liu He and the authorities of the Supreme State Council, stricter measures are needed to defend the domestic financial system.

The statement, released on Friday afternoon, said it was “out of the ordinary” to stop mining and change current trading habits in the cryptocurrency market to address major social risks.

In this context, according to messari, the price of the most popular cryptocurrency slides by 10%, to $ 36,000, with the news from the “dragon country” already making the rounds of the world.

Bitcoin is down more than 40% from its all-time high of $ 64,000 in April.

Other cryptocurrencies also recorded strong losses, with ether losing almost 12%, Binance Coin falling more than 14% and Dogecoin falling more than 12%.

Just two days earlier, China had banned financial institutions and payment companies from providing cryptocurrency trading services and warned investors to avoid such speculative transactions.

Multiple blows

The announcement by the Chinese government comes a day after the announcement of the regulation of the cryptocurrency market in the United States of America.

In particular, on May 20, the US Treasury Department announced that it would require any transaction over $ 10,000 to be reported to the Public Revenue Service (IRS).

As a result, the most popular cryptocurrency slipped again below $ 40,000, until, finally, bandwidth stabilized in it.

“Cryptocurrencies are causing significant problems, facilitating illegal activities,” the statement said.

“This is why the President’s program includes additional resources for the IRS to be able to handle their development.

Under the new scheme, cryptocurrencies and cryptocurrency transfer accounts, as well as cryptocurrency payment service accounts, will be covered.

In addition, as in cash transactions, companies that receive cryptocurrencies with a fair market value of more than $ 10,000 must declare their transactions.

The news caused a slight decline in bitcoin, which now stands at $ 40,000.

Steel nerves and historical corrections

The sharp changes in the prices of cryptocurrencies have brought to the fore two reasons why these assets are at high risk: the limited supply and the lack of a central bank.

This is pointed out by most analysts who comment on the shelling transformations and changes that took place in the cryptocurrency market on Wednesday, May 19, 2021, emphasizing that whoever wants to become a millionaire needs a qualification!

The steel nerves …

If nothing else, it is the most volatile asset, with “hell” away from “paradise”, sometimes just a few hours or even minutes.

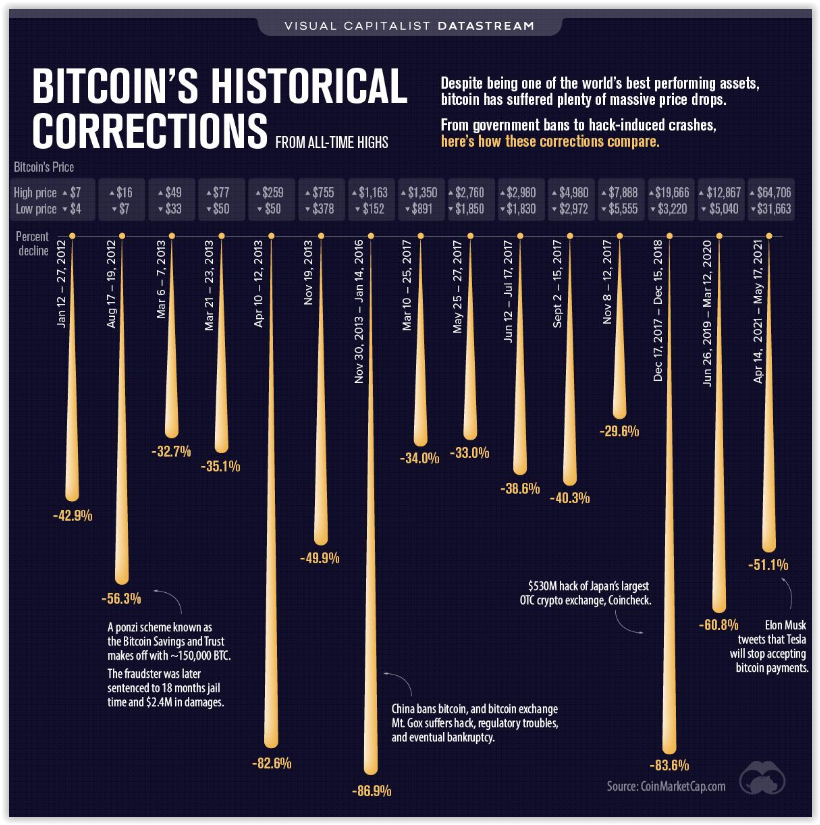

And while Bitcoin remains one of the best assets in terms of performance over the last 10 years, many “corrections” are written… History.

The chart below shows the most historic falls of the cryptocurrency.