The central bank is already piloting the digital yuan, which is available in cyberspace, in mobile applications, as well as plastic cards. The goal is to expand its use throughout the economy.

Cryptocurrencies, with Bitcoin first and foremost, do not just represent a relatively new method of “gambling” in the markets. With their entry into the real economy, especially after Tesla’s decision to allow payment for its vehicle sales to be made in Bitcoin and the many branded and global companies that are expected to follow, they also acquire exchange value.

Thus, they now move to another track and threaten to upset and change for good the monetary balances, which have been based for decades on the omnipotence of the dollar. That is why the first ones who rush to take advantage of the new trend in an organized and central way are – who else? – the Chinese, taking advantage of existing experience and know-how and developing them to their advantage.

“A thousand years ago, when money was synonymous with coins, China invented banknotes. “Today, the Chinese government is designing currencies digitally, redesigning money in a way that could shake a pillar of American power,” the Wall Street Journal wrote in an extremely interesting report.

“Green” domination

It is recalled that according to the data of the Bank for International Settlements (BIS), the dollar is currently the currency used in 88% of all international transactions, compared to only 4% for the Chinese yuan.

The newspaper also seeks to explain the cut. This is because while many may think that “virtual money is already here, as credit cards and payment applications eliminate the need for banknotes or coins. But these are just ways to make money online. “China is turning legal tender into computer code.”

“If we want to defend our monetary sovereignty and the existing legal status, we have to plan for the future,” the China central bank’s project manager told the newspaper, which will obviously have powerful tools to control new digital currency so that it is not subject to παρόμοιες turmoil similar to that of Bitcoin nor is it an easy target for speculators.

At the same time, of course, it will control even more suffocatingly its owners – their transactions, their consumer habits, their very desire.

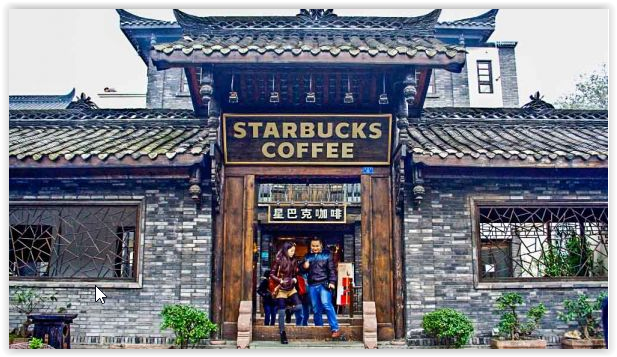

Starbucks, McDonald’s and. Party subscriptions

For now, however, the digital yuan is being tested. It is available in cyberspace, mobile phones or plastic cards for the lesser initiated, and is displayed on a screen in the form of… Mao Zedong. In fact, it does not even require an internet connection to spend.

Evidence shows that 100,000 Chinese have already downloaded the app on their mobile phones, and can make limited transactions at various stores – including Starbucks and McDonald’s branches in China. The KK also enables its members to arrange their monthly subscriptions in this way.

Will this process lead to the gradual digitization of China’s entire monetary system, as some have already argued? It is unknown at this time what he will do after leaving the post.

What is certain, however, is that Xi Jinping wants to associate his name with a major breakthrough at this level. A cut that may prove decisive for China’s position in the international arena.

What will Washington do?

But what is the reaction of the US and the competent authorities to the developments and plans of Beijing? For now, information coming from Finance Minister Janet Glenn and Central Bank Governor Jerome Powell shows no concern or rush to plan for the digital dollar.

Others, however, take a different view – such as former IMF executive and current Atlantic Council member John Lipsky: “Anything that threatens the dollar is a matter of national security. “And that threatens the dollar in the long run.”

Are you saying the new monetary war is digital?