The rapid rise in stablecoin issues could, in a reasonable amount of time, pose a direct threat to the financial markets, according to Fitch Ratings.

In particular, the possible contamination of the financial markets associated with the liquidation of stablecoins could put strong pressure on the imposition of an even stricter regulatory framework in relation to the fledgling “fixed currency” sector.

In this case, it is worth noting that stablecoins are cryptocurrencies that are linked to an asset or currency such as the dollar or the euro.

We can also refer to them as fixed currencies.

They are so named as they are adjusted so that their price has a fixed value.

The Tether

The aforementioned risk of contamination is related to the collaterals of stablecoins that confirm the size, liquidity and risk of the holder of the specific digital assets.

Less risks are created by currencies that are fully backed by safe, liquid assets.

For example, the USD Coin, the second largest stablecoin, is backed by US dollars in a 1: 1 ratio, with fiat currencies held in bank accounts.

However, stablecoins that use fractional reserves or adopt higher risk assets may be at greater risk.

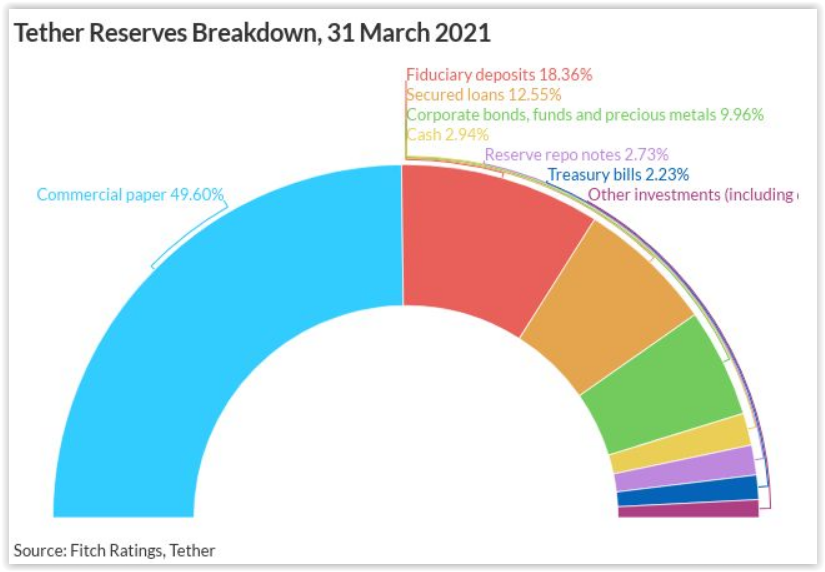

For example, Tether, the largest issuer of stablecoin, revealed that as of March 31, 2021 it held only 26.2% in cash compared to the cryptocurrencies it had issued.

The rest of its reserves were frozen deposits and government bonds, with 49.6% of them being commercial bonds (CP).

In other words, as of March 31, 2021, Tether held $ 20.3 billion in commercial bonds, while its consolidated assets stood at $ 41 billion and are likely to grow even further.

The total assets associated with Tether in US dollars on June 28 reached 62.8 billion.

According to Fitch, the above data suggest that corporate bond holdings may be higher than those of most funds on both Wall Street and emerging markets.

A sudden massive takeover of Tether could affect the stability of credit markets if combined with a sell off in corporate bonds.

It is recalled that, in a similar case, a fully secured coin, Iron, zeroed in June…

Is it stable?

Meanwhile, projects that could be done quickly systemically, such as Diem, have caught the attention of regulators.

As Fitch reveals, US regulators have also noted that “entities” with asset-like distributions similar to Tether’s may not be stable if short-term credit margins widen significantly, as in periods of economic stress in 2020 and 2007. -2008.

If nothing else, this contradicts the way in which fixed currencies are “marketed” to the public.

In this climate, regulating the stablecoins market could improve the level of transparency and turn collateral into less risky assets.

The process can also affect – or be influenced by – the circulation of central banks’ digital currencies.

According to Fitch, the authorities are unlikely to intervene to save stable currencies in the event of turmoil, in part because of moral hazard.